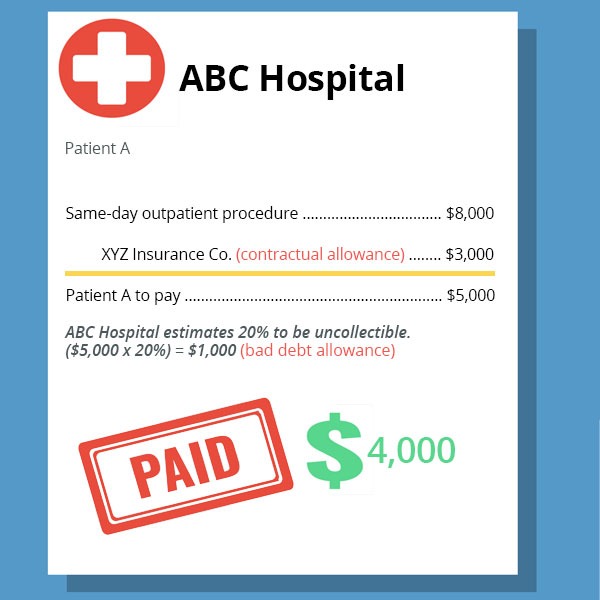

Unlike most other businesses, healthcare providers often deal with multiple parties throughout the billing process, such as patients, third-party insurers, and government programs (such as Medicare and Medicaid). While the interaction and agreements with these parties impact cash collections for services rendered, it’s almost impossible for these providers to be sure how much they will ultimately collect.

Key Takeaways

- Definitions:

- Contractual Allowances: Reductions in billed amounts based on agreements with insurers and government programs.

- Bad Debt Allowances: Estimates of amounts uncollectable from patients, recognized after collection efforts fail.

- Differences and Implications:

- Revenue Impact: Contractual allowances adjust gross revenue at billing, whereas bad debts affect net revenue upon collection failure.

- Tax Considerations: Bad debts are tax-deductible only after being definitively written off.

- Strategic Management:

- Maintain separate financial accounts for clear reporting and compliance.

- Regularly review collection policies to adapt to changing insurance contracts and payer mix.