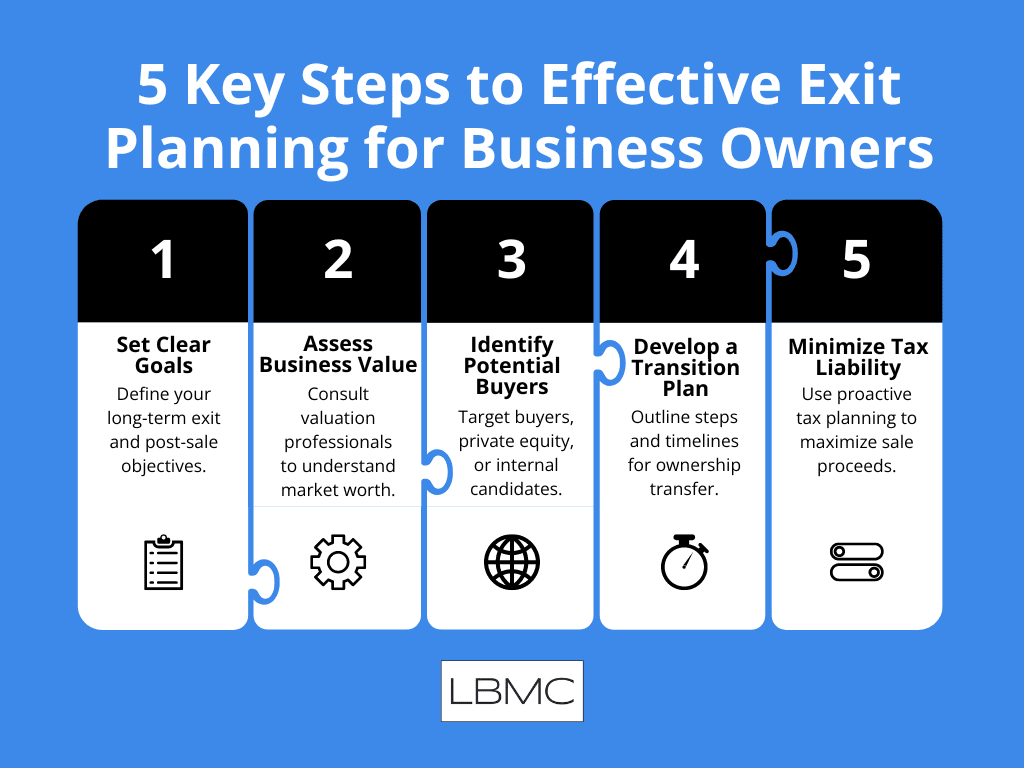

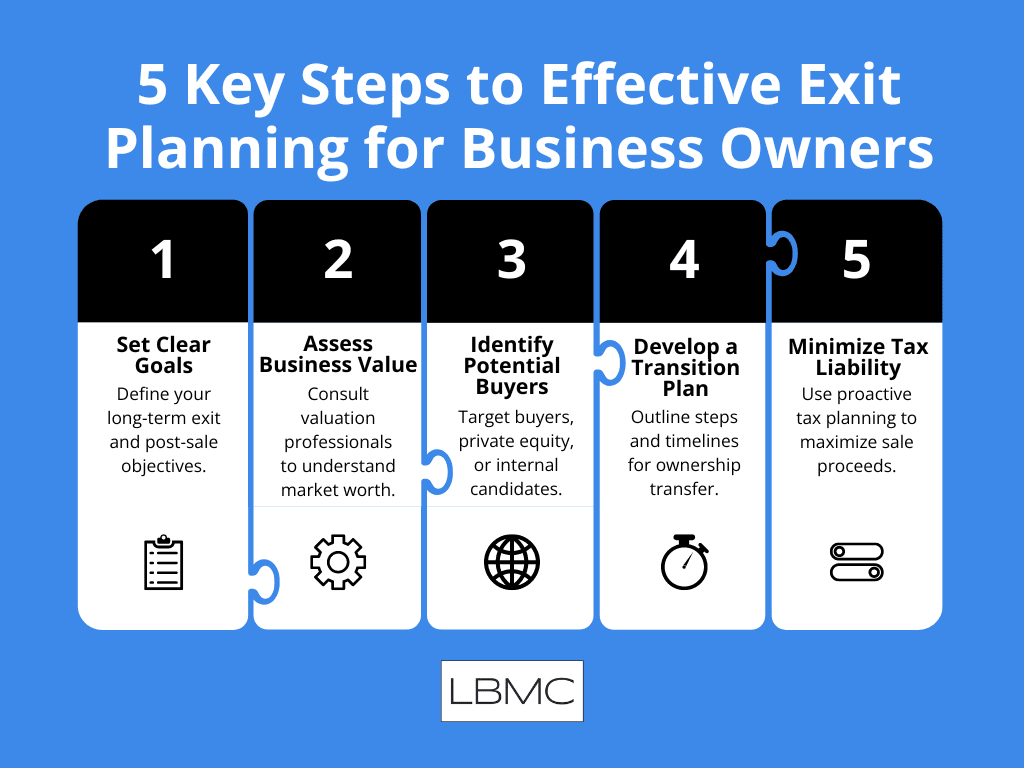

Here are some key steps to consider when creating an exit plan for your business:

1. Set Clear Goals

Clarifying your long-term objectives helps you to develop an exit strategy. Choose if you wish to sell to key people, to family, or for the best price. Review your post-sale plans—that of launching a new business or retiring—and evaluate the money required to enable your preferred way of life. This clarity will direct your exit plan.

2. Assess the Value of Your Business

The state of the market defines the value of your company. See experts in valuation to ascertain its market value and pinpoint problems needing work. Improving bookkeeping or revenue diversification will help your business valuation be better, therefore guaranteeing the highest potential return.

3. Identify Potential Buyers

Identify potential buyers based on your business’s nature and your goals. This might include strategic buyers, private equity firms, or internal candidates like employees or family members. Advisors with industry connections can help find the right buyers, leveraging their networks for the best match.

4. Develop a Transition Plan

Create a comprehensive transition plan once you have a buyer. Setting a schedule and organizing knowledge transfer will help to guarantee a seamless transition. Often related to performance criteria in the selling agreement, you could have to stay temporarily to preserve continuity.

5. Minimize Tax Liability

Sales of your company could cause a big tax load. For best tax efficiency, arrange the transaction with a tax professional using proactive tax planning. Use tax incentives and techniques to reduce your tax load so you can keep as much of the sale money as you might possibly want.

Every situation is unique, which is why it’s so important you find an experienced tax advisor you can trust.